How to Identify Fake GST Invoice?

Introduction

It is compulsory for the registered taxable person under GST to issue an invoice for each supply made by him. The invoice will contain all the detailed and valid information including GSTIN, product information, date, payment method, quantity of product, bifurcation of tax and so on. If a taxpayer issues any invoice and fails to provide the above-mentioned vital information then, in that case the invoice will be considered as fake GST invoice.

Ways to identify t Fake Invoices under GST

The following are some of the effective means to identify fake GST invoice;

The person must have a valid GST registration

Under GST regime, if a person is not registered under GST, then he cannot charge GST or issue GST invoice. Under GST, the following are the persons who required a GST registration;

- Any person whose annual turnover is more than Rs. 20 lakh ( The threshold limit for special category state is Rs. 10 lakh)

- A person engaged in inter-state supply of goods

- E-commerce operators

- Any other person as needed under GST law

It is to be noted that any other person who does not fall under the above-mentioned categories also has to obtain a GST registration.

GSTIN must be mentioned on the Invoice

GSTIN is provided to each and every taxpayer registered under GST. It is a 15 digit unique identification number. Also, it is compulsory under GST law that an e-invoice must have a valid GSTIN so that the input tax credit claim can be made easily.

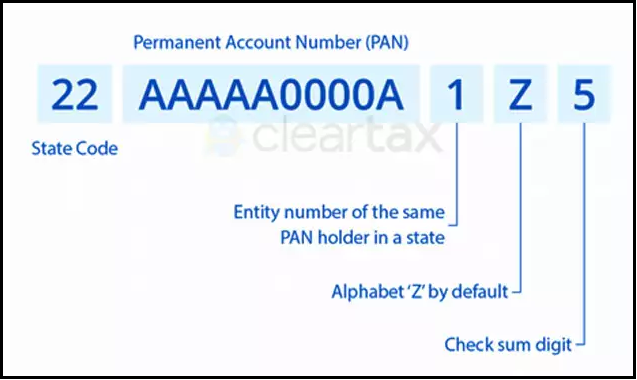

The structure of the GSTINs must be accurate and effective

The following are the detailed correct and accurate structure of GSTIN;

- GSTIN must be in 15 digit alphanumeric format. In the same format it is given to every registered taxpayer

- The first 2 digit of GSTIN represent unique state code that is assigned to the taxpayers.

- The next 10 digits will represent the PAN (Permanent Account Number) of the business

- The next digit will represent the number of branches that a business has in that specific state.

- The 14th digit will be Z. it will always stay constant in every GSTIN issued.

- The last digit will be irregular in nature, it may be a number or letter meant for official checks to be conducted by GST authorities.

A relevant picture depicting the above-mentioned details is annexed below:

Correct GST Rates must be mentioned

There may be certain cases when a taxpayer may charge wrong GST rates by mistake or unknowingly. The reason may be that the supplier may not have accurately sorted each and every particulars or the supplier may have committed an error while providing details of SGST and CGST.

If any of the aforesaid issues occur, then the taxpayer must visit the GST portal and check the GST rates for that particular product or service that is supplied. By checking on the GST portal, the taxpayer will also have an idea to identify if the goods and/or service supplied are exempted under GST.

A valid GSTIN must be mentioned on the Invoice

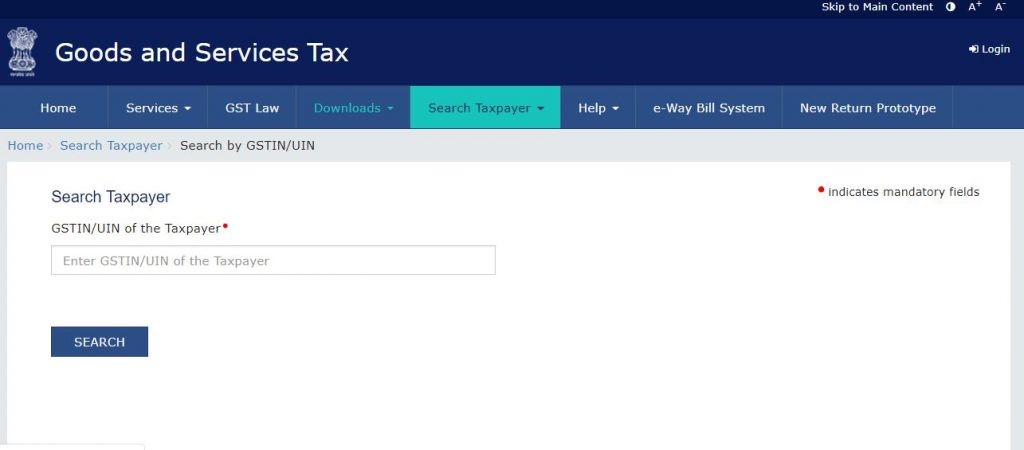

If a taxpayer suspects something wrong with the invoice, then he has the option to verify its authenticity easily of any GSTIN by login into the GST portal. The following are the detailed steps to verify if the GSTIN mentioned on the invoice is fake or genuine;

Step 1:

First Login into the website of GST i.e. https://www.gst.gov.in and click on the option ‘Search Taxpayer’ provide the GSTIN number on the option ‘Search by GSTIN/UIN’. A screen print depicting the is annexed below;

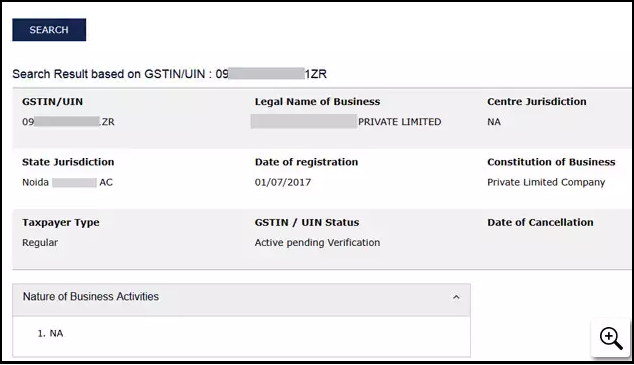

Step 2: After entering the GSTIN click on the option ‘Search’. If the GSTIN provided is correct, then the below provide screen will be displayed which will show the company name, date of registration, state etc.

However, if the GSTIN entered is incorrect then a message will be displayed stating “The GSTIN/UIN entered is invalid. Please enter a valid GSTIN/UIN.” Apart from that if the portal displays a message stating "active pending verification", in that case the GSTIN is valid. In simple words, it means that the business has already applied for GSTIN and has been provided a provisional GSTIN which is mentioned on the invoice.

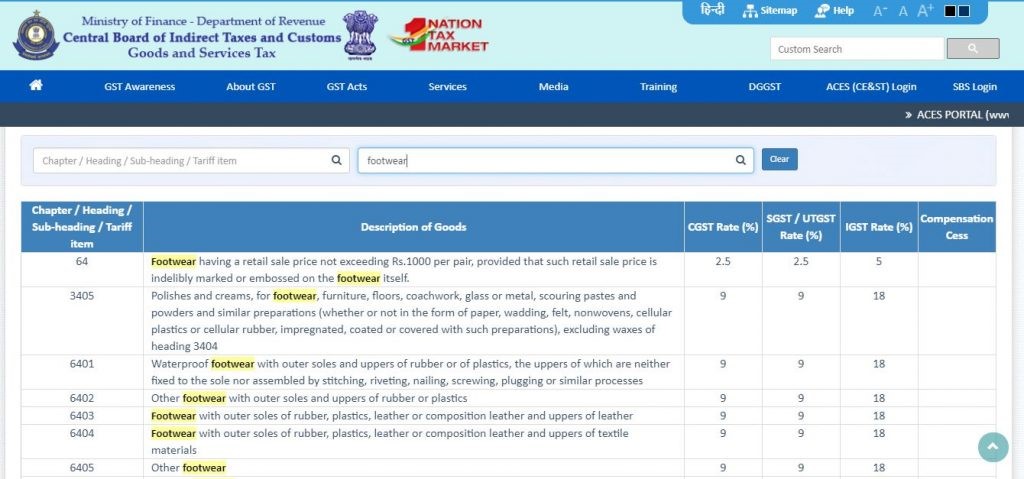

Methods to check if GST rate Charged by Supplier is Correct

After verification of accuracy and genuineness of GSTIN, a taxpayer must check the accuracy of the GST rates applied. The taxpayer can verify the same by login into the GST rate chart provided on the website of CBIC. This can be done by searching either by HSN code or by product name. A screen print depicting the same is annexed below;

Please note in case the taxpayer is searching by product name, it must be ensured that it falls under the correct HSN code as there are various products with same name may have different HSN code basing on their description and thus, it can have multiple tax.

Bottom Line

As mentioned earlier, it is compulsory for every business engaged in providing supply of goods and/or services to get itself registered under GST and accordingly, the businesses has to issue the invoice containing a valid GSTIN. On the invoice it is required to show the detailed breakup of Central GST, State GST and Integrated GST. Apart from that it very crucial to know the particulars of the invoice and check whether GST invoice issued by the supplier is fake or genuine. Thus, the taxpayer must visit the GST portal and check the GST rates for that particular product or service that is supplied. By checking on the GST portal, the taxpayer will also have an idea to identify if the goods and/or service supplied are exempted under GST.

However, we already know that the Government of India has been working continuously towards the prevention of incidents related to tax evasion and invoicing of fake GST. Thus, it is necessary for us to help ourselves by using the above-mentioned ways to spot fakeness of invoices under GST.

Team Tax4wealth